Lithium and the Energy Transition

Lithium demand is growing and more sustainable and effective methods of extraction are needed to meet this demand. That’s where Direct Lithium Extraction (DLE) comes in.

As the world moves into a future powered by batteries, lithium’s light weight and high energy density make it the most sought-after metal for electronic devices of all kinds.

At the same time, the way lithium is obtained from the ground is undergoing a revolution as well, as Direct Lithium Extraction (DLE) displaces the inefficient, environmentally damaging methods of the past. With its more sustainable practices and better recovery rate, IBAT DLE is the premier version of this improved class of lithium extraction techniques.

Here is what the current landscape for lithium looks like and the vital role it will play in the world of tomorrow…

Lithium Demand Is Exploding

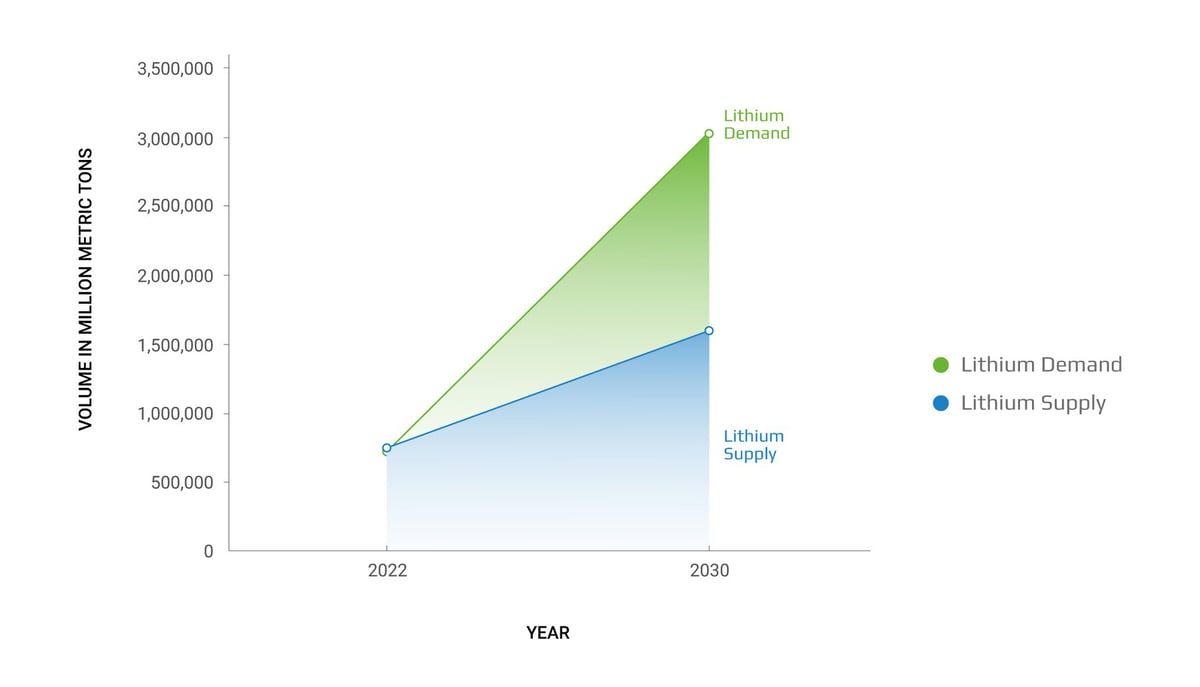

Global Lithium Supply and Demand

Lithium demand, supply, pricing data, and pricing forecasts are available through a number of price reporting and intelligence agencies.

The energy transition is the key driver of this meteoric rise. As electric vehicles (EVs) increase in popularity, kilotons more of lithium are needed to manufacture their batteries. Expanded renewable energy infrastructure is also spurring the need for more battery storage, as are 5G devices and the “Internet of Things” (IoT) networking of billions of previously “siloed” appliances and devices.

Growing Demand for Lithium-ion Batteries

Although lithium is used in making ceramics, glass, lubricating grease, fine chemicals, pharmaceuticals, high-tech products, and more, it’s batteries that have experienced the biggest demand growth for the metal as an end-use. Batteries’ lithium consumption worldwide rose from 23% in 2010 to 74% in 2021.

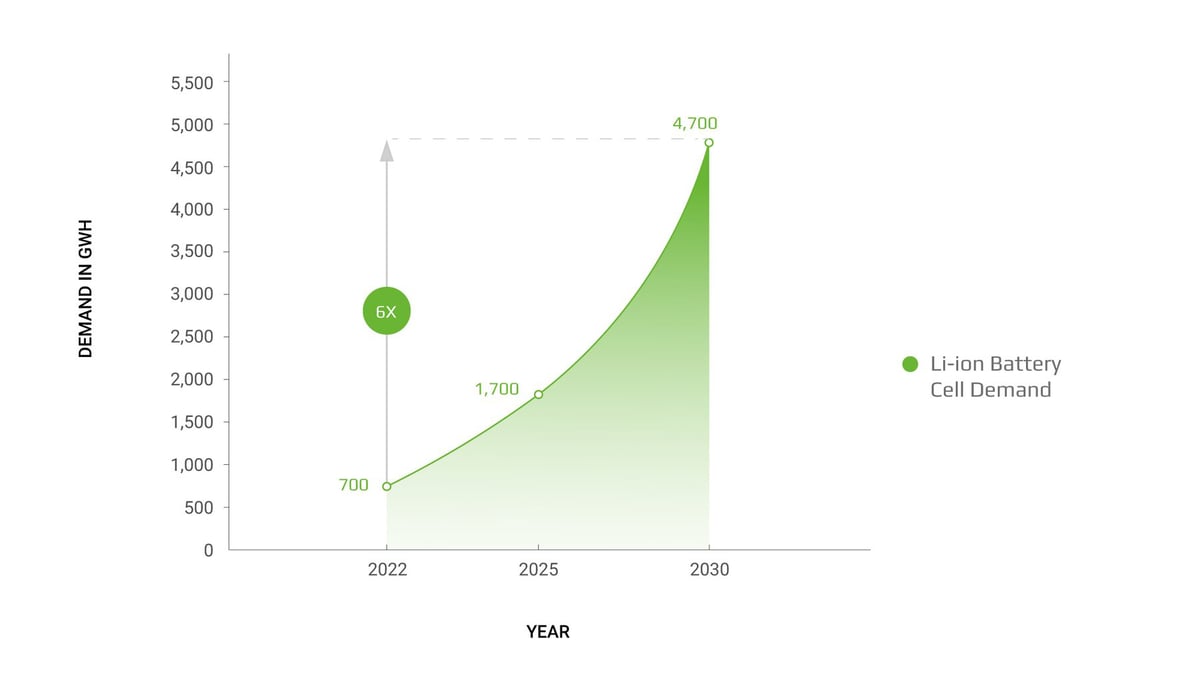

Lithium-ion battery demand is expected to increase annually by around 27% to reach 4,700 GWh by 2030.

Global Li-ion Battery Cell Demand

Lithium-ion Batteries Are Used in…

EVs

Cellphones

Home battery storage

Laptops

Tablets

Grid-scale storage

Power tools

Server farms and Load Leveling

Increasing EV Demand

A confluence of factors is driving increased consumer demand for electric vehicles. For one, government incentives have made buying new EVs more affordable, with up to $7,500 in tax credit available currently. Average EV prices have also continued to decline to the point of being almost equivalent to the average (gas-powered) new car price, thanks largely to the falling cost of EV batteries.

Historically high gas prices in recent years have also pushed new car buyers towards EVs, and manufacturers have taken note. From the commuter cars of household names such as Tesla and GM to the ultra-luxe models from emerging players such as Aspark, Porsche, and Genesis, the wide variety of available options has created a market where there’s something for everyone.

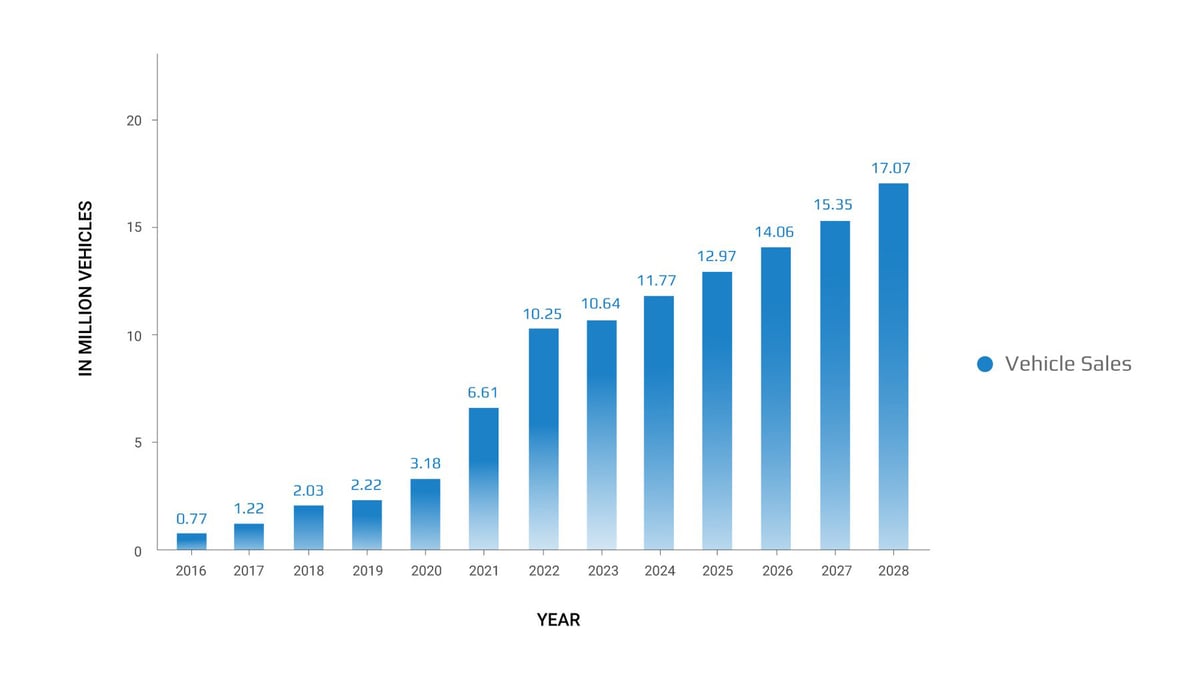

More than 17 million EV sales are forecast by 2028.

Global EV Unit Sales

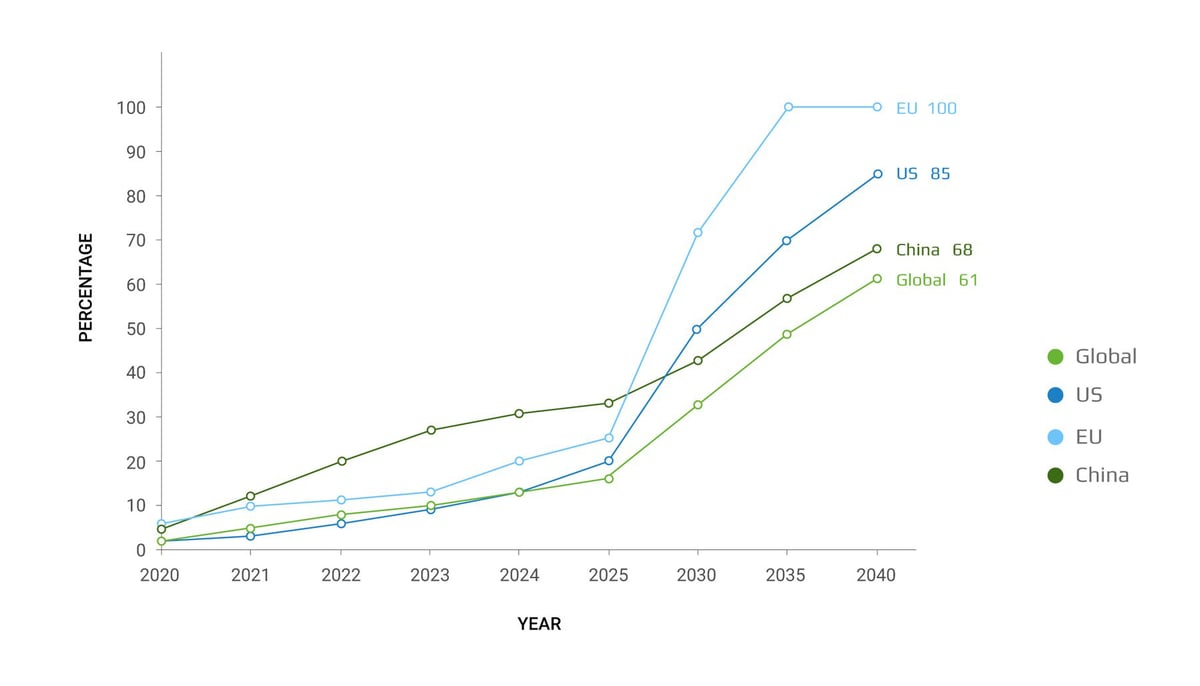

Over 60% of car sales in 2040 will be EVs.

EV Sales Ratio (%)

Over 60% of car sales in 2040 will be EVs.

Current Lithium Extraction Methods

These are the two most common means of obtaining lithium carbonate:

Hard Rock Mining

Lithium is often obtained through open-pit mining, in which miners use explosives to blast holes in the ground that are then refined by heavy machinery into workable pits. The gathered spodumene (lithium-rich) ore is then trucked to a processing plant for the lithium to be extracted and refined through a labor-intensive, multi-step process.

-1-1.jpg?width=599&height=398&name=mining%20(1)-1-1.jpg)

Solar Evaporation

To recover lithium from salar brine, or salty groundwater, solar evaporation is often used. In this process, brine is pumped to the surface into large ponds lined with high-density polyethylene (HDPE) or reinforced polyethylene (RPE), where the sun will concentrate the lithium over 18 to 24 months.

Despite high concentrations of lithium in the brines used, the extraction efficiency–even after the necessary purification steps that follow evaporation–is low, around 40-50%.

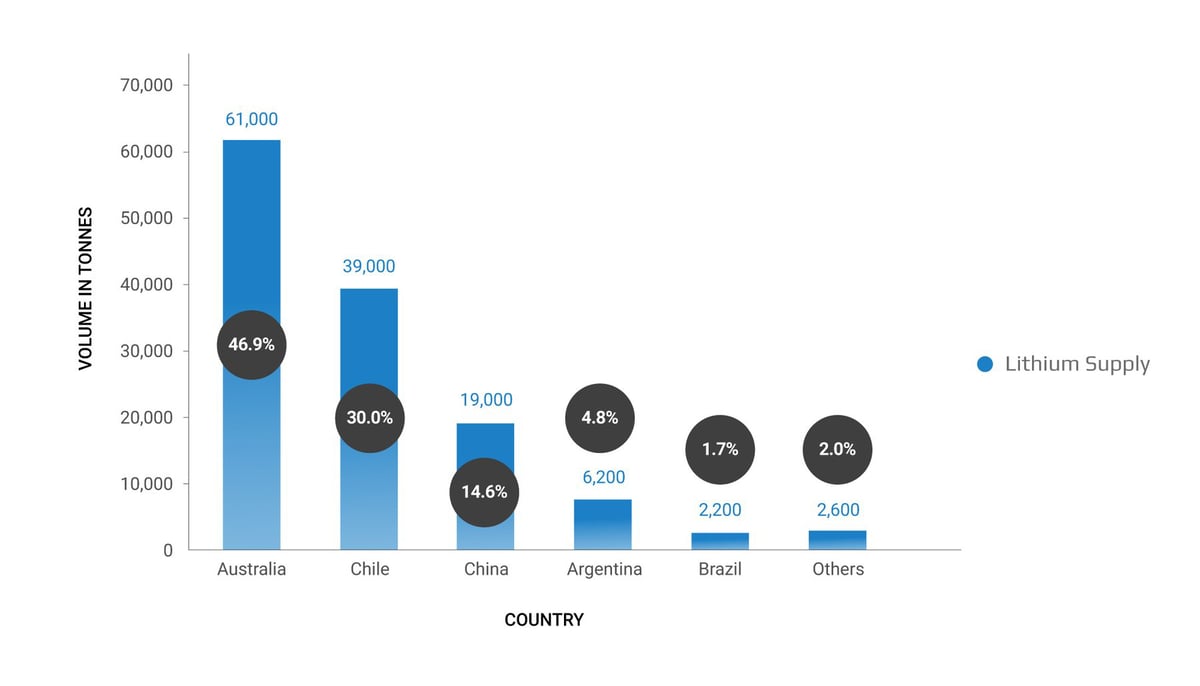

Lithium Extraction Around the World

Currently, most of the lithium extracted from brine comes from salar mines in Argentina, while hard rock mining is concentrated in Australia, Canada, and China.

Global Lithium Supply

Growing Lithium Extraction in the U.S.

At the end of 2023, the United States had only one active lithium mine in production. However, the domestic extraction landscape is poised to change dramatically.

According to S&P Global Market Intelligence, companies budgeted more money to explore lithium deposits in the US than any other country in 2022. Also in 2022, the Department of Energy (DoE) allocated $12 million “to advance the science of safe, cost-efficient lithium extraction and refining from geothermal brines.” The DoE followed this up with a $700 million loan to a mining company to develop another lithium mine in southwestern Nevada.

And perhaps most game-changing of all, a lithium reserve along the Oregon-Nevada border called the McDermitt Caldera has already been identified and is believed to be the largest in the world, although production there is not currently underway.

Environmental Concerns and Slow Production Times of Traditional Methods

Part of the reason lithium extraction has been paltry in the U.S. is Americans have resisted attempts to mine in their communities, and with good reason: the typical mining processes have numerous deleterious effects on local ecosystems.

The heavy machinery used in hard rock mining generates heavy air pollution, while scarring the landscape. The drilling and size reduction work consumes thousands of gallons of freshwater, while thousands of gallons of heavy metal-laden wastewater called acid mine drainage are generated and sent into local water systems. The surface hydrology of the pit area is permanently changed, making flooding a real risk.

Solar evaporation consumes even more freshwater than hard rock mining, often in arid climates where local residents can little afford to have their aquifers depleted. The waste salts from spent brine are also left behind in piles in the desert.

Each method is also energy-intensive, with large amounts of typically non-renewable energy required for processes such as crushing, grinding, and chemical separation.

DLE and the Future of Lithium

Brine is where lithium extraction will be focused in the coming years–it’s easier to get out of the ground and requires less capital. Of course, as we’ve seen, solar evaporation is literally unsustainable as a method of obtaining lithium from brine.

That’s where DLE comes in. Eliminating the need for solar evaporation ponds, lime plants, and salt piles, direct lithium extraction from brine offers a greener, faster process that results in higher quality lithium, in higher quantities.

IBAT DLE is the greenest version of direct lithium extraction to be proven under real-world conditions. It grants producers a faster time to market, getting new technology into the hands of tomorrow’s consumers that much quicker.

Get Started Today

Reach out to us now to hear what IBAT DLE can do for you.